Jan Borgonjon and James Sinclair discuss how multinationals can respond to the growing pressures of operating in China today.

- Multinationals are looking to scale up and outpace market growth over the next five years, says our China Business Forecast.

- To achieve their growth targets, multinationals recognize that they must become more “Chinese” in China, with a fully localized operation required within 5 years for most. For those operating in “restricted” sectors, this is needed for market access, while the imperative for those in “open” sectors is improved competitiveness.

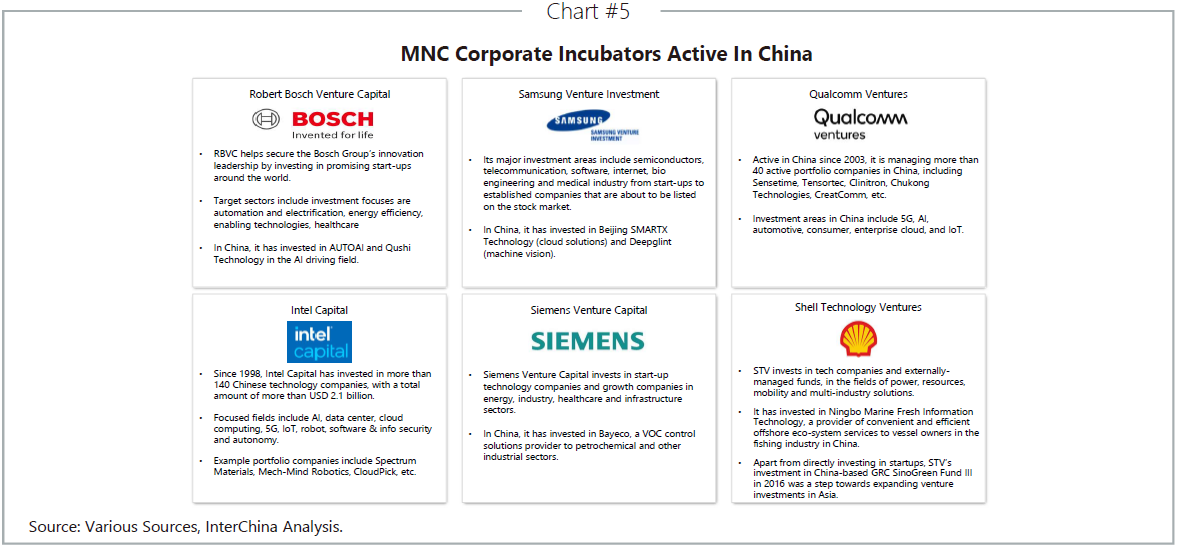

- Some multinationals are now starting to engage with the new Chinese technology ecosystem through incubator investments, capability share partnerships and cross-domain acquisitions.

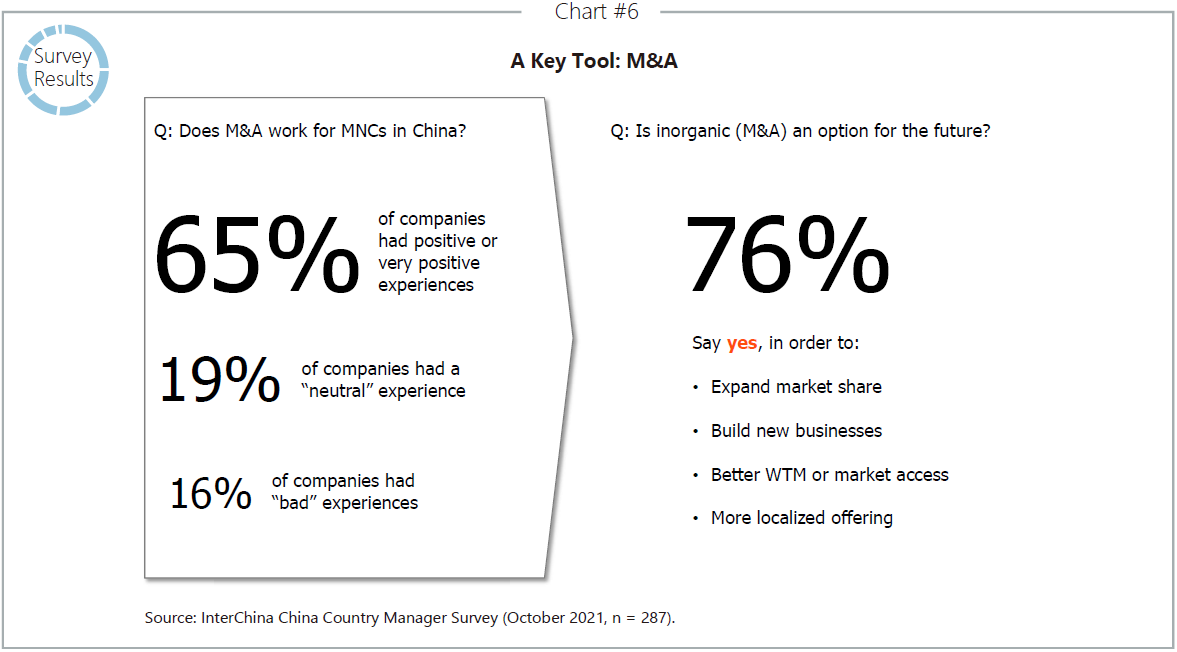

- Inorganic growth is a key strategic tool to achieve these objectives, with previous deals in China haven proven positive for most. Preference for partnerships has re-emerged, with the deployment of two-phase deal structures.

- It is critical to reshape your China governance model to achieve further flexibility, speed and responsiveness, while continuing to leverage the strengths of being a global company.

*** This is the second part in a two-part series. In the first part, we looked at how 2021 was a significant year in terms of the changing business environment for multinationals operating in China. In this second part, we will discuss how multinationals should respond to the new business landscape ***.

Entering 2022, China country managers need to begin by asking themselves five key questions:

- Where does the ‘new China’ stand in my global strategy in terms of the market, competition and scale?

- What does it mean to ‘be Chinese’ for our company, and do I need to decouple from China?

- Am I fully capturing the Chinese innovation boom and do I understand (and need to be a part of) new local technology ecosystems?

- What is the role of inorganic growth for our business, and do I need to consider M&A activity?

- What governance models will allow our business to be close to China but still retain our corporate DNA?

We will now explore each of these questions in turn.

Market, competition and scale

As we discussed in the first part of this article, sector consolidation is now a huge economic driver across China and scale is becoming one of the main goals for most multinationals.

Our China Business Forecast interviewed almost 300 China country managers in October and November 2021 from across a broad range of sectors, and one of the key questions we asked was how they expected the structure of their sector to evolve over the next three years.

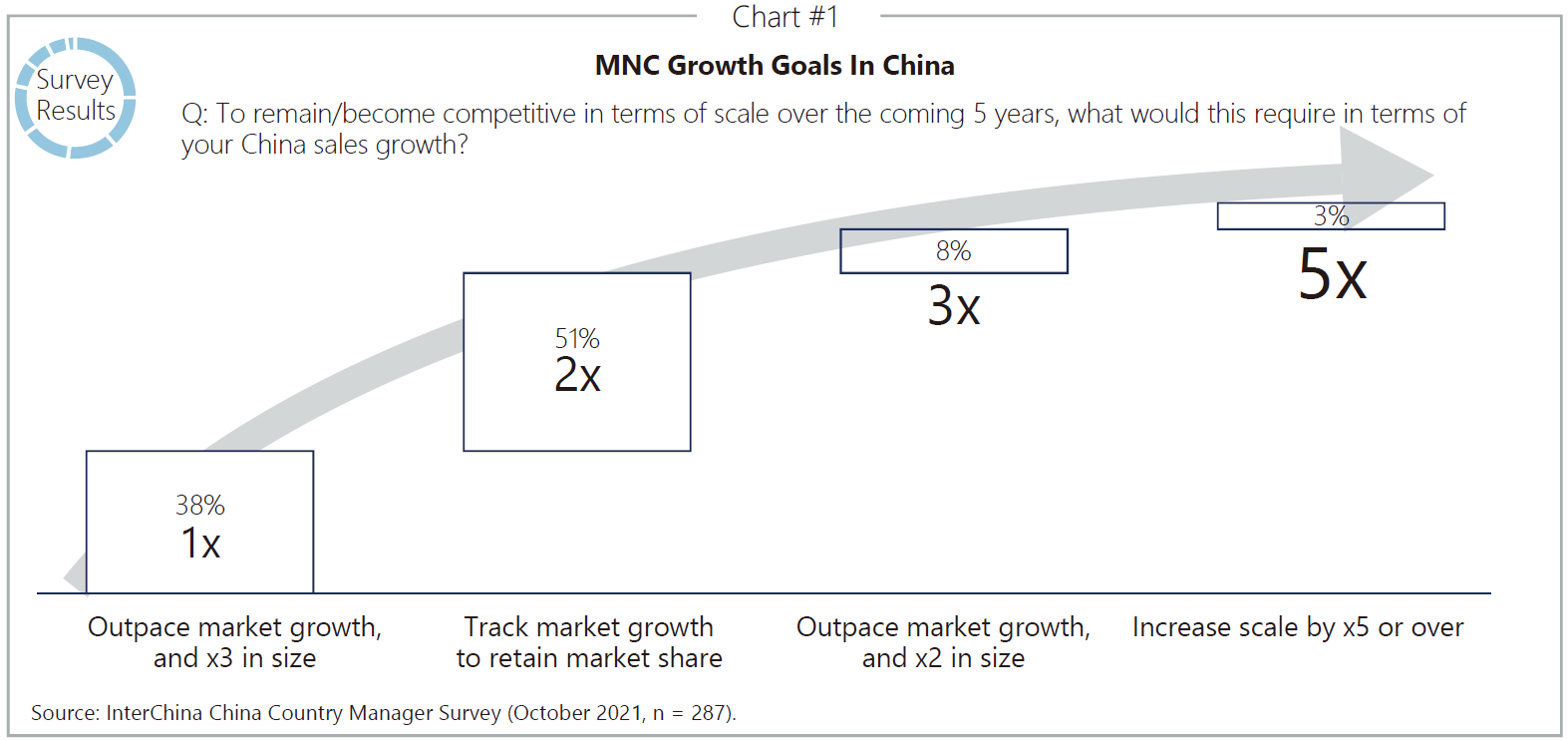

Some 60% of respondents said their sector would become more consolidated, while almost 85% said scale was now either key or important to being competitive in China. As a result, almost two thirds told us they were looking to scale up and outpace market growth over the next five years.

What does it mean to be “Chinese”?

To achieve their growth targets, multinationals recognize that they must become more “Chinese” in China. In our survey over two thirds said that a fully localised China operation would be required within five years, and more than half of that number said it was necessary right now.

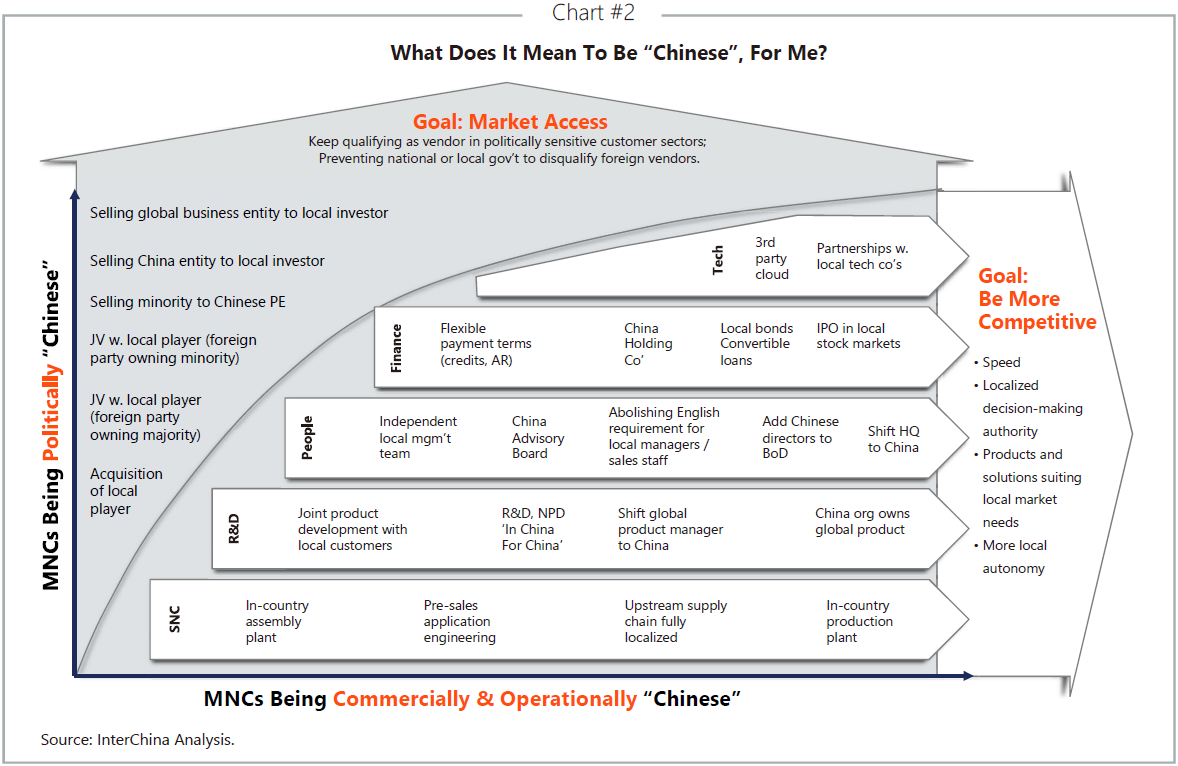

For a given multinational, what it means to be “Chinese” depends on the nature of the sector they are operating in. As we discussed in the first-part of this article, sectors are either “open”, where companies are free to compete as normal, or “restricted”, meaning they are dominated by state-owned companies.

For those multinationals operating in more “restricted” sectors, the primary objective is market access, and avoiding being disqualified by central or local governments in procurement processes. That means becoming more “politically Chinese”, which they can do in various ways: acquiring or entering into a joint venture with a local player, selling a minority stake to a Chinese PE house, or even selling a whole Chinese operation to a local investor.

Conversely, becoming more “operationally Chinese” is the primary objective of multinationals operating in “open” sectors. That means building stronger in-market capabilities to bring decision-making closer to market, accelerate speed and responsiveness, and better develop and deliver solutions to meet local market needs. There are many in-house measures that multinationals can adopt, and most are someone along the journey already:

- Supply chain management: have an assembly plant, production plant and pre-sales application engineering operation all in China; fully localise the upstream supply chain.

- R&D: become less reliant on HQ driven R&D; have joint product development with local customers; shift your global product manager to China; think about acquiring a local R&D team; register Intellectual Property locally

- People: run an independent local management team; create a China Advisory Board; abolish the English requirement for local managers and sales staff; add Chinese directors to your board of directors; shift HQ to China.

- Finance: Introduce flexible payment terms; have a China holding company; consider an IPO in local stock markets; give a Chinese operation full P&L responsibility.

- Technology: Forge partnerships with local technology companies.

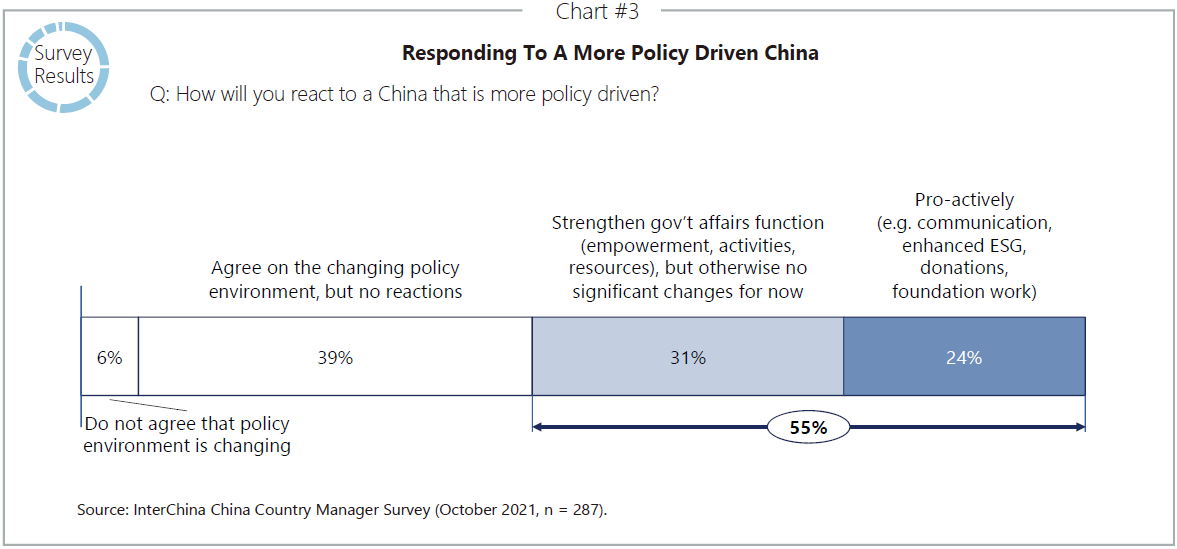

Regardless of “open” or “restricted”, multinationals are also responding to China becoming more policy driven. In our survey, almost a third said they were strengthening their government affairs function, while a quarter said they were being more proactive.

Participating in local technology ecosystems

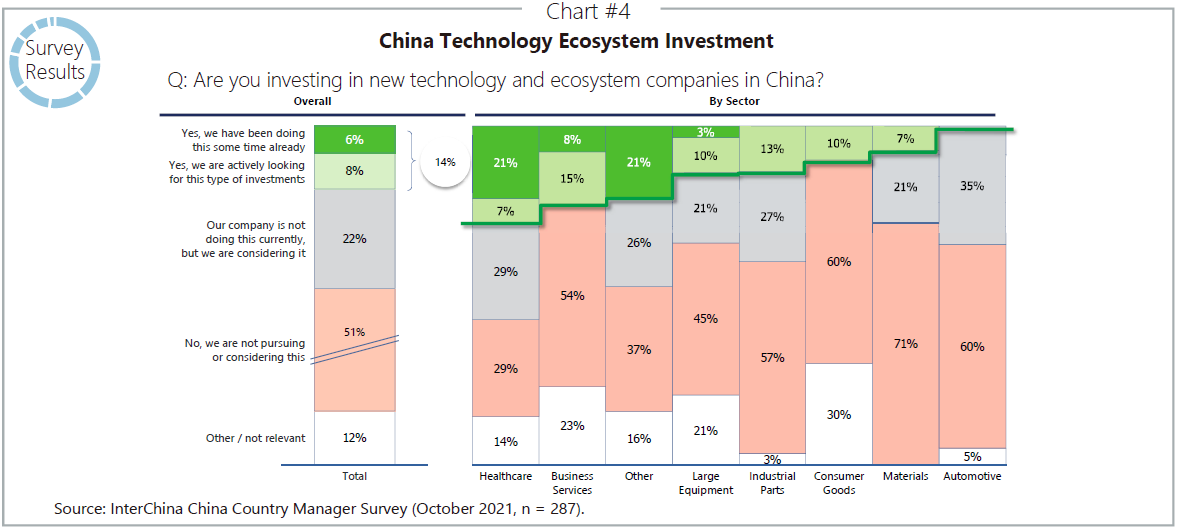

A small but meaningful share of multinationals are already active in building technology ecosystems in China. In our survey, some 14% said they had either been making related investments for some time already or were actively looking for these types of investments, most notably in the healthcare sector. A further 22% said this was under consideration for the future.

Corporate incubators are one vehicle that multinationals use to form technology ecosystems in China, complementing their in-country R&D functions and joint venture innovation centres. The incubators are investing in local start-up companies active in foundation technologies and innovative solutions, some now with dozens of portfolios companies.

M&A activity

Against this backdrop it is clear that inorganic growth will become a key strategic tool for multinationals to achieve their objectives in China. The good news is that our survey found that two thirds of respondents have had positive or very positive experiences of M&A activity in China, and three quarters said inorganic growth was an option for the future to help drive scale and localisation.

One of the most striking findings of our survey was the re-emergence of partnerships. Two thirds of multinationals said they were ready to enter into partnerships, much higher than in previous surveys we have run, and almost a third said they were open to a 50/50 or minority share (as opposed to majority control). There were quite significant variations according to sector. In automotive, healthcare and materials the appetite for JVs was particularly strong, less so in business services.

Consistent with previous surveys, high valuation expectations remain the biggest deal challenge for doing deals, with multiples of more than 12x EBITDA in many sectors.That said, Chinese listed companies have now become much more attractive with the valuation of such companies no longer at a premium.

The two-phase deal structure, taking a minority share first, and then enlarging to a controlling share at a later point in time, has become increasingly popular. This has proven to help attract owners that are considering IPOs, bridge valuation gaps, and incentivize a smooth transition.

Governance models

Reshaping your organisation to achieve flexibility, speed and responsiveness in China is now a key part of becoming more “Chinese”. Central to any reshaping is governance, and there are a number of specific measures that could be introduced.

Shifting global HQ

Multinationals could relocate their global, divisional or APAC headquarters to China in what can be a highly symbolic move. The number of multinationals which have now established regional HQs in China increased by 53 in 2020 to 953, continuing the significant upward trend of recent years, with four fifths based in Shanghai. Numerous multinationals have also shifted divisional HQs to China in recent years, including ABB, AMD and Pfizer.

Corporate reporting lines

It has never been more pressing to have a clear alignment between HQ and China teams. For instance: a China head could take full control of all business units and functions in China and report directly to the global CEO; the China head could also be part of the global board; more of a global management team could be moved to China; and a global R&D champion could be moved into the China organisation.

China Advisory Board

Setting up a China advisory board can be an effective way to facilitate communication in a more focused and systematic way, creating an effective bridge with HQ and sharpening the China strategy. The Board would ideally be composed of the multinational’s China country manager, APAC or international head, corporate representatives, a few external ‘old China hands’, and a previous CEO or Vice President.

Summary

To achieve their growth targets, multinationals recognize that they must become more “Chinese” in China, with a fully localized operations. For those operating in “restricted” sectors, this is needed for market access, while the imperative for those in “open” sectors is improved competitiveness. Acquisitions will be an important vehicle for many in the pursuit of localization, as well as participating in China’s technology ecosystem. Not all will have the answers to the questions posed, but as we enter 2022, these are questions that now need addressing.

English

English