The success of Volume Based Procurement in slashing costs has had a huge impact across the wider healthcare industry, says Rick Woo.

- Far wider use of Volume Based Procurement (VBP) across pharma and medical devices sectors - More products likely to be targeted for VBP, especially those which consume a lot of healthcare budgets

- Pharma companies shifting products which have not been successful under VBP to retail channels instead

- Growth of VBP market being matched by rapid expansion of Contract Research Organisation (CRO), Contract Manufacturing Organisation (CMO), and Contract Sales Organisation (CSO) industries. Anatomical Therapeutic

- Pharma and medical devices businesses doubling down on digitalization leading to more product innovation and cost control which are important tactics for VBP.

Two years ago I wrote about how the recently introduced National Drug Centralized Procurement Scheme (China healthcare channel cascade heralded by policies) – which had just started to be rolled out with the aim of cutting drug costs and consolidating public hospital procurement – was set to have a huge impact on the Chinese healthcare sector.

Today that pilot, which began in four municipalities and seven cities, is widely regarded as having been a huge success by health authorities, so much so that it has led to a far wider and deeper use of the model across high consumption markets such as pharma and medical devices as regulatory control over hospitals tightens further.

That initial pilot involved 25 drugs and notably only two of the 25 contracts were awarded to multinationals, an early taste of how the model – since known as Volume Based Procurement (VBP) - has eaten into their margins and forced multinationals to drop their prices as low as local products to be successful.

Response

So how should multinationals respond to this rapidly changing landscape? How do they now sell their products in the most cost-effective way, and how do they need to change their business models?

Let’s be clear, despite the impact on margins no multinational is going to exit China. After all, it is the second largest health market in the world and still growing.

So in response they are often turning their focus and resources towards innovative products which are not subject to VBP and which will sell at a higher margin. They are also employing different distribution models, and upping their digital strategies which in turn bring product innovation and cost control. Retail and e-commerce channels have also become increasingly important.

Rise of the model

The VBP model was first introduced in therapeutic areas, starting with chronic diseases such as hypertension, coronary heart disease, diabetes and digestive diseases, and then extended to drugs for critical diseases such as lung cancer, breast cancer, colorectal cancer, and other rare diseases. Last year also saw the centralised procurement of insulin, the first time the model had moved from chemical to biological drugs.

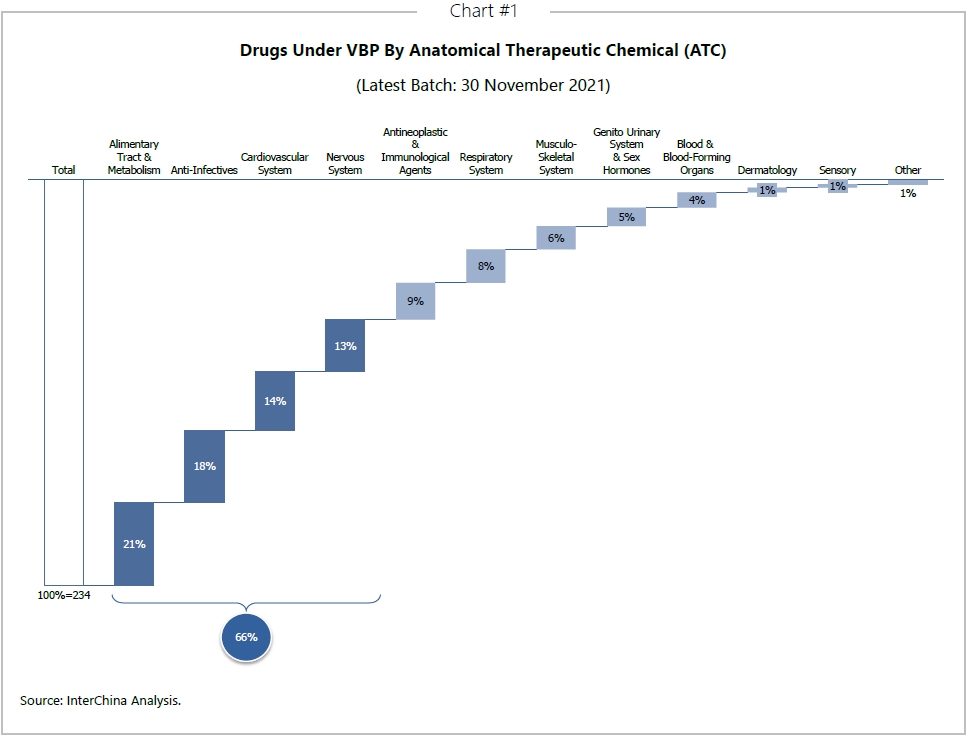

Looking ahead, a number of other products are now likely to be targeted for VBP, especially those which consume a lot of healthcare budgets and where the most savings can be made. For instance, according to Anatomical Therapeutic Chemical, just four categories - alimentary tract and metabolism, anti-infectives, cardiovascular system and nervous system – currently account for two thirds of the total number of drugs in VBP.

Significantly these were all among the top six biggest categories of drugs in China by sales value in 2018. As such the categories of pharmaceuticals products that are most likely to be further included in the coming years are antineoplastic and immunological agents, and blood and blood-forming agents, which are both within the top four categories of drugs in China by sales value before VBP but only account for 9% and 4% of the total number of drugs in VBP now.

Medical devices

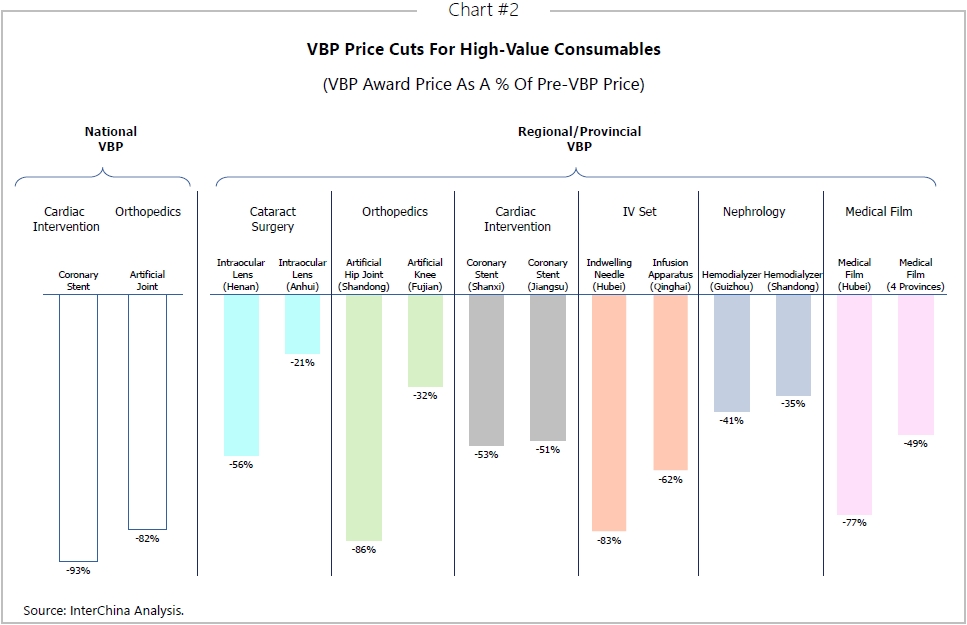

The model has now moved into the medical devices sector too. Contracts for coronary stents and orthopedic artificial joint implants are now implemented at nationwide level and the VBP price has dropped dramatically (see chart below). Other products such as coronary drug-coated balloons, other orthopedic implants, intraocular lenses, dental implants, pacemakers, and hemodialysis products are also under VBP at regional and provincial level and are likely to be considered for future national VBP too.

Market impact

Shift to retail channel

A major impact of VBP is that it has made pharmaceutical companies shift products which have not been successful under VBP into retail channels instead. As I have said previously, within retail pharmacies the attraction of well-known branded drugs has far greater traction. Whereas in hospitals patients are not given the choice of a foreign brand as a result of the central purchase policy, in a pharmacy they do have a choice and can be prepared to spend more.

Focus on innovative drug development

In the face of fierce product competition and the compression of profit margins under VBP, multinational pharma companies are increasingly focusing on the development of innovative drugs. One of the reasons is that the level and quality of clinical research of local enterprises in China still needs to be improved and so China is accelerating the research and development of new drugs, and the domestic listing of new overseas drugs. In 2020 alone, 40 new drugs have been approved for marketing in China.

Rapid growth of CXO

The development of innovative drugs has further expanded the rapid development of the Contract Research Organisation (CRO) sector. If a pharma company wants to develop a new drug, it generally needs to go through the following seven stages - drug discovery, preclinical research, investigational new drug application, clinical trial, new drug application, large-scale production, and marketing.

The business services provided by CROs cover the first five stages, while the last four stages can be provided by either a Contract Manufacturing Organisation (CMO), pharma companies, or by a Contract Sales Organisation (CSO).

In recent years a series of policies to encourage the development of service outsourcing and pharmaceutical reform have been successively introduced in China, which has accelerated the gradual standardisation of China's pharmaceutical CRO industry, and means that the Chinese government is also providing more support and resources for the development of the industry.

For instance, companies with products included in VBP have begun contracting with CSOs to reduce sales and marketing costs.

Responding to the challenge

So how should multinationals respond to the challenges posed by VBP?

Go-to-market optimisation

Optimise relationship with agents

With products centrally purchased pharmaceutical and medical device companies only need to be responsible for the follow-up distribution process and are therefore less dependent on agents.

Under the traditional agency model although the products were produced by pharma and medical device companies the agents controlled the operations and even product pricing. With VBP, product ownership and rights have been transferred back to pharma and medical device companies once again, and many will now reduce their cooperation with agents. This is more obvious for medical device companies which may increase their own sales manpower and shift some of the marketing role to third party agencies.

Optimise organisation structure

VBP has also prompted pharma companies to optimise their organisational structures. Specific actions include increasing regulatory personnel, optimising sales teams, and strengthening marketing teams. For instance, Pharscin Pharma has two major products that have won VBP bids, namely aluminum magnesium carbonate chewable tablets and polyethylene glycol 4000 powder. The company has announced plans to establish a new marketing centre, cancelled the sales department of products not listed in VBP, and merged its original commerce department and key account team into one department. The goal is to optimise the organisation structure, increase marketing resources to promote products not participating in VBP, and moderately reduce sales manpower of VBP products.

Digital transformation

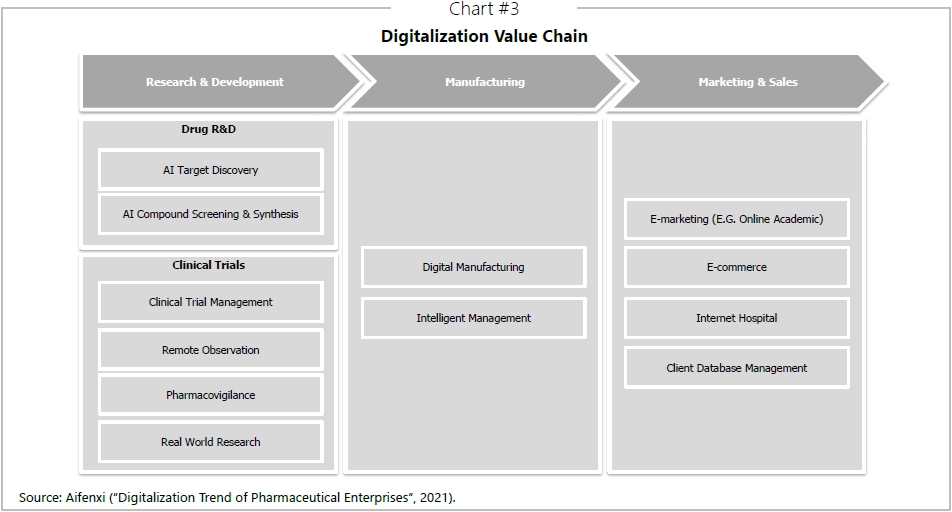

Pharma and medical device businesses are doubling down on digitalisation, knowing that it will bring product innovation and cost control, both important for VBP. Additional benefits include product quality optimisation and compliance monitoring.

Digital applications can be applied throughout the drug life-cycle, from drug research and development through to clinical trials, digital production and digital marketing.

Digital R&D

Artificial Intelligence (AI) and other technologies are being increasingly used to innovate all aspects of new drug development, whether that’s target discovery, AI compound screening and synthesis, clinical trial management, compliance information management for application and approval, or real-world research.

Such innovative R&D models can lead to faster product development, and digitalization effectively reduces the risk of R&D failure, shortens the R&D cycle, and reduces R&D costs. For instance, Huadong Medicine and Jingtai Technology are using quantum physical models and AI algorithms to achieve cost reduction and increased efficiency in drug development.

Digital manufacturing

Intelligent manufacturing helps ensure stable drug quality and reduces production costs. It helps visualise and control pharmaceutical production and not only reduces deviations and errors caused by manual operations, but also ensures the compliance of operating procedures and information transparency, thereby ensuring the quality of pharmaceutical production and reducing production costs.

Digital sales & marketing

Effective digital marketing can expand brand awareness, build reputation and increase sales, especially with low margin VBP products, while it can also help control compliance issues.

Healthcare companies increasingly use digital marketing methods, such as using virtual representatives to reach more doctors and patients, which can not only save costs but also better track the performance of marketing campaigns. Through channels such as WeChat, companies are also turning to offline conference live streaming to help strengthen contacts and interaction with doctors.

For instance, AstraZeneca and JD Health are working together, integrating AstraZeneca's experience in disease treatment with JD Health's businesses - such as pharmaceutical supply chains, Internet medical care, and health management – to jointly build an innovative patient service and chronic disease management system. JD.com has created an online and offline integrated patient service model for family doctors.

Summary

Health authorities now have considerable experience in terms of the planning and implementation of VBP which has led to a dramatic reduction in medical costs. As such the policy will continue to be rolled out across the pharmaceutical industry, while high value medical devices will be the next focus.

In this new landscape digitalisation will be critical as products included in VBP will still need to be strongly promoted via channels such as e-marketing to ensure that companies gain market share. Players will either develop their own in-house digital capabilities, or may work with existing CSO partners. For companies with products not listed in VBP, which are selling products through retail or e-commerce channels, the selection of capable and reliable partners to help deliver their digitalisation strategies will be critical.

Meanwhile to compensate for loss in sales due to VBP, or lower margins with VBP products, companies will need to bolster their investment in new product development and commercialisation. They will either do this in-house with digitally enhanced R&D, or license in products from other companies. With the new products in the pipeline, they will then need to engage with reputable and reliable CROs to speed up the regulatory process and clinical trials for product approval.

English

English